The Digital Single Market Strategy initiative identified eGovernment as one of the key elements to maximise the growth potential of the digital economy and to achieve an inclusive digital Europe. The EU announced the launch of an eGovernment Action Plan 2016-2020, setting out the vision, underlying principles and policy priorities, highlighting the Modernisation of public administration with ICT.

As part of the first pillar, the use of disruptive technologies (block-chain, big data, IoT, virtual reality, AI, etc.) in public administrations is growing and can be very beneficial. Tax Administrations have been very active testing new technologies to fight tax avoidance, but without analysing the impact in the taxpayers´rights.

That´s why, even if in the tax field these technologies can enhance a greater tax, is necessary to ensure taxpayers rights, within the EU and globally. However, the real potential impact of such technologies and the ways in which they can disrupt the existing landscape of tax collection are largely unknown.

That´s why and connected with action 24, the main objective of our project will be an specific Digital Government for Citizens Charter related with tax collection, including what can Citizens reasonably expect from these services, from new technologies and from the Tax Administrations using or offering them. This Charter will provide citizens with a set of principles aimed at clarifying what Citizens may reasonably expect.

This Charter will be based in the outputs of the following areas of research:

- Digital transformation of Tax Administrations

- New taxpayers rights for a digital Administration era

- Big data, Artificial inteligence and machine learning for tax fraud avoidance

- Use of Blockchain by Tax Administration: VAT fraud avoidance

- Internet of things as tool for tax fraud avoidance (income tax, VAT and customs)

- International Analysis of Digital transformation of Tax Administrations and New taxpayers’ rights In Comparative law

- Digital Government taxpayers’ charter.

Team

Institutions

Deliverables

7 Working papers

- Digital transformation of Tax Administrations

- New taxpayers rights for a digital Administration era

- Big data, Artificial inteligence and machine learning for tax fraud avoidance

- Use of Blockchain by Tax Administration: VAT fraud avoidance

- Internet of things as tool for tax fraud avoidance (income tax, VAT and customs)

- International Analysis of Digital transformation of Tax Administrations and New taxpayers’ rights In Comparative law

- Digital Government taxpayers’ charter.

Summary of findings

- Digital transformation of Tax Administrations

- New taxpayers rights for a digital Administration era

- Big data, Artificial inteligence and machine learning for tax fraud avoidance

- Use of Blockchain by Tax Administration: VAT fraud avoidance

- Internet of things as tool for tax fraud avoidance (income tax, VAT and customs)

- International Analysis of Digital transformation of Tax Administrations and New taxpayers’ rights In Comparative law

- Digital Government taxpayers’ charter.

Book: Digital Transformation of Tax Administrations, Tax Fraud and new Taxpayers rights

- Digital transformation of Tax Administrations

- New taxpayers rights for a digital Administration era

- Big data, Artificial inteligence and machine learning for tax fraud avoidance

- Use of Blockchain by Tax Administration: VAT fraud avoidance

- Internet of things as tool for tax fraud avoidance (income tax, VAT and customs)

- International Analysis of Digital transformation of Tax Administrations and New taxpayers’ rights In Comparative law

- Digital Government taxpayers’ charter.

Research

Considering the nature of the proposed Project, a first study of the new technologies that have begun or can be implemented by the Tax Administrations becomes unavoidable. For this, it will be necessary an understanding of how they work, the singularities, similarities and differences that they have in their programming, for which it will be necessary to read from the point of view of other sciences, informatics, primarily, in order to clarify how they operate. Therefore, studies outside the legal or economic world will be necessary to understand them.

Once this question has been clarified, the consequences of the application of new technologies by tax administrations in the legal-tax area will have to be analyzed. To this end, it is indisputable the need to conduct separate investigations, not allowing the possibility of a general analysis in where the different applied technologies work in a divergent way, differing in their scope of application and, therefore, their impact on Financial and Tax Law will inevitably be different. Thus, activities will be held (Workshop, webinar, seminars, ...) depending on the specific technology in question to see what is its operation, how to index tax management as well as in the procedure of application of taxes, to order, on the one hand, to observe what possible rights and guarantees of taxpayers may be affected, as well as to be able to establish a statute for the taxpayer that collects new rights and guarantees for the application of these new technological models.

Therefore, during the initial phase of the research, descriptive works will be developed considering the doctrine of computer science to, second, use the inductive method in the next phase, consisting of seeing which rights and guarantees are affected, in order to establish that new regulatory framework that will reflect the new rights and guarantees thereof. The legal and economic doctrine of Financial and Tax Law of Spain, Italy, Croatia, Holland, Argentina, Canada, USA, United Kingdom and France will be used for this purpose. It will also analyze the resolutions issued by the EU organisms, as well as other international organizations (UN, OECD, IMF). In this line, interpretive criteria, economic-administrative resolutions and case law will be sought.

To achieve good conclusions, the research activities will be complemented by another kind of activities, such as workshops, seminars/webinar, PAMs, in order to prepare, discuss, contribute with other ideas from other academics, professionals, policy-makers,… raising critical knowledge that will cause a benefit for both parts: Tax Administrations and taxpayers.

Finally, our conclusions will be published in English by the Institute for Fiscal Studies with the porpuse of covering society, not only academics, but also tax Administrations, other professionals as barriers or tax advisor, policy makers, and, generally, taxpayers because of the importance of the subject.

Book

- Digital Transformation of Tax Administrations, Tax Fraud and new Taxpayers Rights

Working papers

- Digital transformation of Tax Administrations

- New taxpayers rights for a digital Administration era

- Big data, Artificial inteligence and machine learning for tax fraud avoidance

- Use of Blockchain by Tax Administration: VAT fraud avoidance

- Internet of things as tool for tax fraud avoidance (income tax, VAT and customs)

- International Analysis of Digital transformation of Tax Administrations and New taxpayers’ rights In Comparative law

- Digital Government taxpayers’ charter.

Events

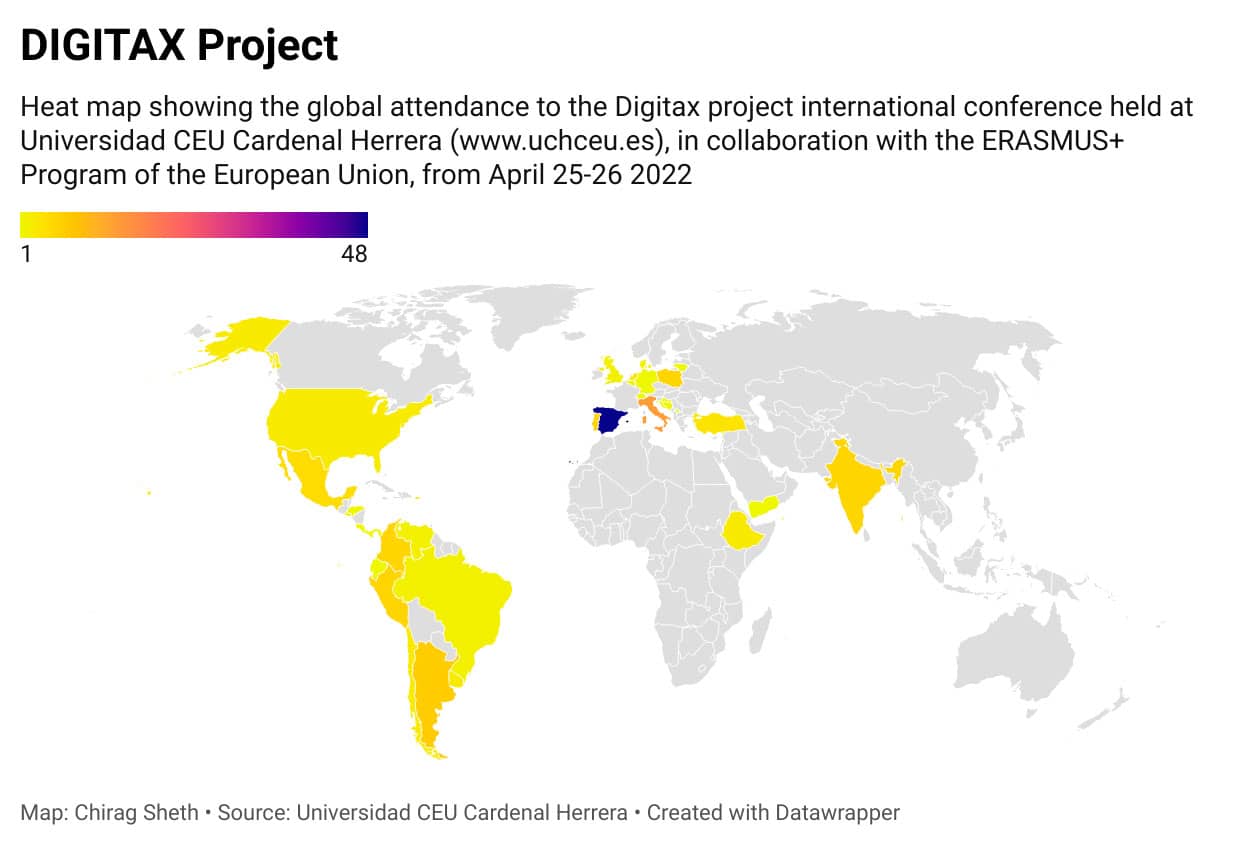

Jean Monnet - DIGITAX PROJECT International Conference 2022

Impact

- Expertos internacionales analizan en el CEU la transformación digital de las administraciones tributarias de la UE

- Retos de la digitalización de Hacienda y su repercusión en los contribuyentes

- Jean Monnet - Digitax Project - International Conference

- Faculdade de Direito da Universidade de Lisboa - Official publication Facebook

Av./ del Seminario, s/n, 46113, Moncada, Valencia, Spain

Tel.: 0034 96 1 36 90 00 Ext.: 62347

Email: [email protected]

LinkedIn: Digital Transformation of Tax Administrations in the EU

Iñaki Bilbao Estrada

Iñaki Bilbao Estrada specializes in teaching and researching in the area of Tax Law. He holds a bachelor’s degree in Law and a European doctorate (cum laude) awarded by the University of Valencia and Universidad Cardenal Herrera – CEU respectively. He has also studied an MBA (CEU San Pablo) and an Expert E-learning University course (Open University of Spain – UNED). After a research scholarship with Fundación San Pablo he was appointed Lecturer in Financial and Tax Law at UCH-CEU. He has presented and organized numerous courses, seminars and conferences in many different foreign countries, and has made various research stays in foreign universities. He was Visiting Scholar at the University of Berkeley and guest lecturer at various other universities. He is member of the Spanish Association of Tax Lawyers, the Spanish Association of Tax Law, the International Fiscal Association and the European Association of Tax Law Professors. He has published extensively and received various prizes, among them: Second prize in the XXI Annual “La Ley” Awards, first prize in the “Estudios Financieros” (Tax) Awards, and special commendations in Editions XIII/XIV of the “Estudios Financieros” (Tax) Awards. He has been the main researcher in three projects funded by the Spanish Ministry of Education and Culture, and is Director of the ENDESA Research Chair of Taxation and Climate Change at UCH-CEU. His current research is focused on the digital transformation of tax administrations and the new taxpayers rights needed in this digital era. He also started to research about digital economy, sharing economy and has hold an international conference related with digitalization of tax administration (Technological disruption and Tax Adminstration: Duty to Contribute, Fight Against Fraud, and Taxpayer Rights and Guarantees), in Elche, Valencia, the 15th and 16th of October of 2018. In addition, he has experience in Jean Monnet Proyects because of a proyect given to professor Villar Ezcurra in 2014. Right now he is Vice-chancellor of Internationalization and he is also leading the digital transformation of the University CEU Cardenal Herrera. |

Marta Villar Ezcurra

Professor Villar is Full Professor of Tax Law at the CEU San Pablo University. She has hold the “ENDESA Chair of Taxation and Climate Change”. She is legal advisor of tax law matters. She has been external consultant of the European Commission (TAXUD) and she is member of the IFA Executive Committee. Between 2007 and 2011 she was General Secretary of CEU San Pablo University (Provost), being in charge of adaptation of programs to the EHEA. She has supervised four PhD dissertations (one of them with awards). Dr Villar serves as a Visiting Professor for LL.M. courses on European tax law at several Spanish and foreign universities. She has been Visiting Professor and Visiting Research Fellow at Georgetown Law Centre, Vienna University of Economics and Business, Université Catholique de Louvain-La Neuve, IBFD (Amsterdam). She has published and lectured extensively on a broad range of topics related to Spanish and European taxation, including the State aid provisions and their application on tax measures, Environmental and Energy taxation. She also has research in Comparative Law in different aspects of Tax Law. She is active member of international scientific and professional associations on Tax and Fiscal Law. In 2018th, she has hold the 19th Global Conference on Environmental Taxation, which is an international conference that addresses issues and propose solutions for environmental taxation issues. In addition, in 2014, she coordinated a Jean Monnet Project entitled “Energy taxation and State aid control: looking for a better coordination and efficiency. |

Pasquale Pistone

Pasquale Pistone was born in Naples, Italy on 18 November 1968. |

Cristina García-Herrera Blanco

Professor of Financial and Tax Law at the Complutense University of Madrid and Director of Research Studies in the Institute for Fiscal Studies (Spanish Ministry of Finance), since 2017. Member of several commissions of the Finance Ministry (Taxation and Gender or Wealth tax). Member of the editorial boards of Spanish tax reviews (e.g., Crónica Tributaria and Crónica Presupuestaria and El Cronista del Estado Social y democratic de Derecho). Author of several books and papers on transfer pricing, international taxation, European taxation, Taxation of digital economy, Tax compliance and Corporate tax. |

Irma Johanna Mosquera Valderrama

She is Associate Professor of Tax Law (with tenure) at the Institute of Tax Law and Economics, Leiden University, (The Netherlands). |

José Andrés Rozas Valdés

He is Full Professor of Tax and Financial Law at the University of Barcelona. He obtained his Degree in Law (1987) at University Complutense of Madrid, where he also obtained his PhD in Law (1992). |

Álvaro Antón Antón

Dr Álvaro Antón Antón is an Associate Professor at CEU Cardenal Herrera University (Valencia and Elche, Spain) and postdoctoral research fellow at the International Bureau of Fiscal Documentation (Amsterdam) from 2016 Dr Antón holds an International PhD (cum laude) in Tax Law from CEU Cardenal Herrera University, where he also graduated in Law in 2007 and Journalism in 2009. His PhD thesis “State aid and renewable energies support systems: an analysis of the tax benefits under the Energy Taxation Directive to promote biofuels” was awarded with the 2014 European Academic Tax Thesis Award (EATTA) by the European Association of Tax Law Professors (EATLP) and the European Commission. Currently, Mr. Anton is responsible for lecturing and research at the University CEU Cardenal Herrera in the following areas: EU State Aid Law, Digital Economy Taxation, Corporate Income Tax Law, Tax System and Constitutional Tax Law. In 2014, he was appointed research associate of the International Fiscal Association (IFA) for the term 2014-2015, developing essays on taxation of illegal activities, international tax issues of international sports organizations and international tax issues of venture capital funds. His research interests are European taxation and international tax law. He has authored several articles and book chapters for Spanish and international publications. He also has been a speaker on tax law issues at several conferences, seminars and courses in Europe and Central America. Mr. Anton is also principal researcher of several public funded projects on State aid tax issues and, currently, taxation of the digital economy (funded by the Spanish Science Ministry). Dr. Antón is member of the Spanish branch of the IFA and the Valencia Bar Association. He also leads a national research proyect related with the taxation of the sharing economy. In collaboration with professor Bilbao Estrada, he held the International Conference “Challenges and opportunities of the Tax Administration in the digital era” in Elche, Spain, the 15th and 16th of October of 2018. He also participated in the Jean Monnet proyect carried by professor Villar Ezcurra. |

Lorenzo del Federico

Lorenzo del Federico graduated with honors in the Faculty of Law at the University of Bologna in 1983. He worked as a lecturer at the Faculty of Law of the University of Bologna and taught in the Master’s degree “A. Berliri” in Tax Law (1993-2001). At the moment he is Full Professor in the University of Chieti-Pescara where he also works as co-director of the Master in Tax Law and in the PhD program. He has been a Member of Committees and Working Groups at the Italian Government and at the Ministry of Economy and Finance for significant reforms. He is a Member of Scientific Committees and of executive bodies of several reviews. Moreover, he is co-founder and co-director of the Rivista Trimestrale di Diritto Tributario (Tax Law Quarterly) and of the scientific series Il Diritto Tributario Italiano ed Europeo. In the years 2013, 2014 and 2015 he has been a Member of the Directive Committee of AIPDT (Ass.ne Italiana Professori di Diritto Tributario). He has been member of Doctoral Committee in the University of Catania, in the University of Rome “La Sapienza”, in the University of Salamanca, in the University of Barcellona “Pompeu Fabra", in the University “Alma Mater Studiorum” of Bologna, in the University “LUISS Guido Carli” of Rome. He has been lecturer in several conferences, of national and international significance. Among the most important conferences: the annual conference of EATLP (European Association of Tax Law Professors) in Caserta (2005), the conference of ILADT (Instituto Latinoamericano de Derecho Tributario) in Perù (2014), the annual conference of EATLP in Milan (2015), the conference of ILADT in Mexico City (2015), in Santa Cruz de La Sierra (2016), in Montevideo (2018). He has published four monographs and more than 300 contributions in Italian, English and Spanish and an English volume. He also has researched in Comparative Law in different aspects of Tax Law and He is active member of international scientific and professional associations on Tax Law. He has published in all Tax Law field and, particularly, in taxpayer’s rights, exchange of information, public finance and tax state aid, Digital Economy and taxation, European Tax Law. He promoted and coordinated two research projects of international relevance: “Tax Implications of Environmental Disaster and Pollution” and “Public Finance and Tax Measures for the Cultural Heritage”. He also participated in the Jean Monnet project carried by Professor Villar Ezcurra in Spain (2015-2016). He has been visiting Professor at the University UPEC of Paris (France), at the University of Santander (Spain) and at the IBFD of Amsterdam. |

Álvaro del Blanco García

He currently works as a Deputy Assistant at the Research Department of the Institute of Fiscal Studies and Associate Professor in the Department of Financial and Tax Law of the Autonomous University of Madrid. One of the main investigation areas is European Law. He has participated on the preparation of several publications and presentations on that topic. Finally, He is PhD regarding European law and the autonomous financial system, where he addresses the issues regarding environmental taxation and its problems regarding European law on state aid and the Community freedoms. He also participated in the Jean Monnet proyect carried by professor Villar Ezcurra |

Jesús Rodríguez Márquez

Partner, responsible for the Madrid office and Director of the Tax Practice Area of the firm: 1968. Studies: Law degree from the University of Córdoba (1991) and Doctor of Law from the University of Córdoba (1997). Professor of Financial and Tax Law. He is currently Associate Professor of the same discipline at the Faculty of Law of the Complutense University of Madrid. His teaching activity has been complemented by his participation in international conferences such as the Latin American Tax Law Conference, held in Cartagena de Indias, Lisbon and Salvador de Bahia. |

João Félix Pinto Nogueira

João Félix Pinto Nogueira, PhD in Tax Law, is Deputy Academic Chairman of IBFD. He is also team manager of IBFD Academic and Adjunct Editor-in-Chief of the World Tax Journal. His areas of expertise are international and European tax law, fields in which he has published a dissertation, several articles and book chapters. Dr Nogueira has more than 15 years of experience in teaching at both the graduate and post-graduate levels and is currently overseeing several master's courses on EU and international tax law, taught in different languages. Dr Nogueira is a member of the EATLP, IFA, IFA Portugal (Associação Fiscal Portuguesa) and IBDT. He is the president of YIN-IFA Portugal and a member (and scientific secretary) of the ECJ Task Force of the Confédération Fiscale Européenne. He is also a member of the Executive Board of the ILADT (Diretorio), the Executive Board of IFA Portugal and the General Council of the IFA. He is member of the board (secretary) of IFA Europe Committee. He also participated in the Jean Monnet project carried by professor Villar Ezcurra. |

Ksenija Cipek

She works since 24 years ago for the Ministry of Finance, Tax Administration of Croatia. She is a highly respected and recognised international tax expert who has heavily involved in lawmaking and was responsible for many tax reforms in Croatia. As a Project Leader she established Compliance Risk Analysis System (CRMS) and provided idea solution for automatic VAT refund based on Risk Analysis System in Croatian Tax Administration (2016). She is currently involve, as a Head of Risk Analysis, in a future development of CRM System, connection of tax legislation and CRM System through risk analysys, especially in an analysys of solutions for applying new technologies as a Blockchain and Digital Distributed Ledger. She is Board Advisor of European Network for Economic Cooperation and Development (EUCED A.E.I.E. – E.E.I.G), Member of the European Law Institute (2018), Contributor Member of the Blockchain Chamber of Commerce (USA), Member of a Government Blockchain Association (GBA), Member of the British Blockchain & Frontier Technologies Associations (UK), Member of the OECD group 'Harmful Tax Practices', Member of the Project Group for CRM Guide, EU level, Coordinator of Idea Solution and Regulatory Arrangement of a Special Pre-Filing Taxation Process (2014), Coordinator of Conceptual Solution and Regulatory Arrangement of the Unified Tax Form (JOPPD) 2013, Member of the Tax Advisory Committee (2017), Member of the Strategic Management Committee of the Tax Administration Modernization Project (2016), Member of Advisory Body for Compulsory Tax Rulings (2017), Member of the EU Council Working Group: Code of Conduct (CoC) and Common Consolidated Corporate Tax Base (CCCTB) - 2017, Project Manager "Transitional Instruments - New Applications of the Croatian Tax Administration Information System" (2017), Lecturer at the Faculty of Law of the University of Zagreb - Department: Income Tax, Member of the Working Group in relation to projects for Tax Administration modernization (2015), Member of the Project “General Audit Support” – GAS (2018). |

Alfredo Collosa

He has been virtual tutor and consultant of CIAT since 2008, participating in different modules. He is a professor of university degree and postgraduate and exhibitor in Tax Administration and Taxation. He has a Master´s Degree in Public Finance and Financial and Tax Administration, Tax Administration Specialization (UNED, IEF SPAIN).He has a Certified Public Accountant and a Business Administration graduate, and has an specialization in Taxation. He has been an AFIP official since 1990, and currently works as Chief of Review and Resources. He is author of 8 Books and more than 180 publications tributary issues. He also has participated in numerous courses, including Tax Institutions and Techniques Course (Madrid), IEF International Taxation Course, International Tax Law (Barcelona), CIAT Transfer Prices Course 2016, Collection and Collection Seminar -Cartagena de Indias - CIAT, Symposium Tax Reform - Chile - Padrón Analysis Analysis San Cruz de la Sierra - CIAT, Prices Transfer Seminar CIAT (Montevideo) He has been consultor of the International Monetary Fund and TADAT Trained. He also has research about taxpayers rights and he is working on the applications of new technologies of the tax administration and its implications. |

Marina Serrat Romaní

She is Assistant Professor of European and International Tax Law at Maastricht University since September 2019. Before that she worked as a Tax Lawyer in Barcelona and she was also Lecturer at Abat Oliba CEU University and the University of Barcelona. She has a double BA in Law and Political Sciences at Abat Oliba CEU University (2011) and holds an LL.M. in International Tax Law at WU, Vienna (2012). In 2017 she obtained his PhD in Tax Law at University of Barcelona (Cum Laude) under the title “The Rights and Guarantees of taxpayers in the digital Era. Transparency and Exchange of Tax Information”, supervised by professors Pistone and Rozas Valdés in the fields of taxpayers’ rights, that make her won the Doctoral Extraordinary Award of the University of Barcelona 2018. She has researched about European and International Tax Law, Exchange of Information, Tax Transparency. Recently she has started to research about Digitalization of Tax Administrations and the impact of Robotics and Artificial Intelligences on Law. |

Borja Astarloa Ilarduya

He obtained his license in Law at the CEUUCH in 2014 and his license in Political Sciences in 2015, also at the CEU UCH. He holds a master on Tax Law from the University of Valencia. He is a PhD candidate at CEINDO and in his thesis he addresses the taxation of tha sharing economy applied to transport sector. He obtained a public scholarship for his Thesis and since the academic course 20106-2017 started to teach Tax Law subjects in degrees (Law and Business) and postgraduate level. He is the author of a published work on the VAT related with Airbnb. He also participated in the International Conference hosted by professors Bilbao Estrada and Antón Antón with an oral dissemination of VAT consecuences for Uber and Cabify drivers. Nowadays, he is a research and teaching assistant at the Department of Legal Sciences of the University CEUUCH. He has been invited researcher at the International Bureau of Fiscal Documentation, Amsterdam. Since 2018 he coordinates the Law Blog and social media of the Law Faculty of CEUUCH. |